Need further assistance? Visit Support Centre

Maintaining full oversight of client risk is impossible for most financial institutions. Adopting a risk-based approach means that lower risk client records can go unreviewed for months and years, creating unknown risk exposure.

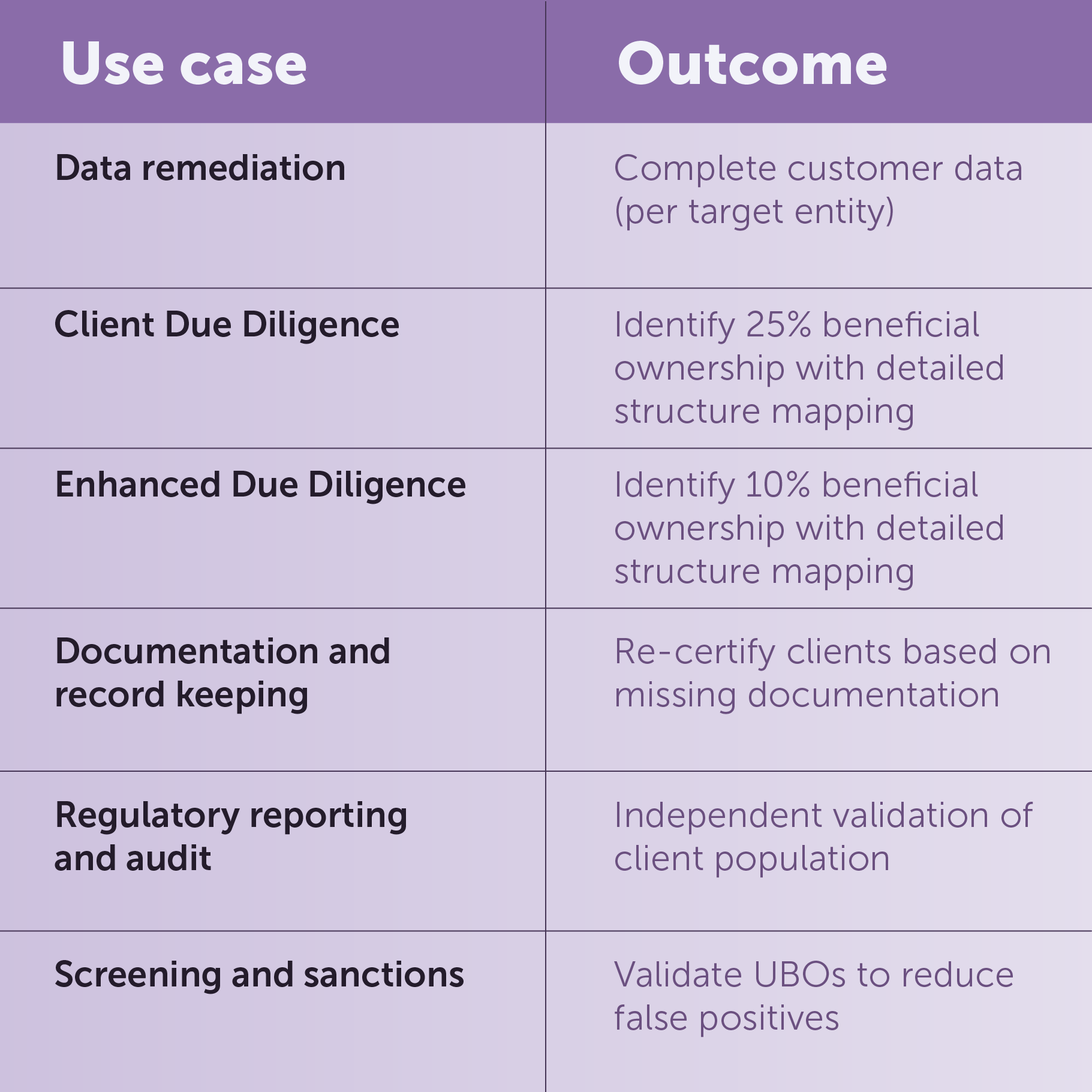

Powered by the EC360 platform, EC Review sources and collates KYC public data and documents in real-time to review client data in bulk, and at scale. Required data attributes or complete client profiles are returned seamlessly into your internal systems, for straight through processing (STP) or analyst review where deeper investigation is required.

Access to extensive global data coverage to ensure reliable and accurate information. Source critical KYC public data attributes and documents in real-time to verify and validate client identity. These include corporate and UBO registries, regulators, and stock exchanges, plus screening, IDV and company business data from leading vendors.

Our global team of KYC, banking industry and technology experts, ensures you maintain compliant client records efficiently through our secure, automated platform for batching, verification, rapid review and resolution. We ensure high data quality and compliance by running the process for you and highlighting exceptions that need investigation. Outreach and your internal team’s workload are reduced, all with a full audit trail and compliance assurance.

Our award-winning KYC public data solution is used by the world’s leading banks to identify and verify clients from onboarding and throughout the client lifecycle.

Let Encompass do the hard work for you with our automated KYC refresh and remediation solution.